Natercia Verdial joined Blue Ventures in March 2022 as a Fisheries and Livelihoods Senior Manager in Timor-Leste. Natercia uses her expertise to support women to identify and introduce alternative livelihoods in their communities. Here she talks about her recent work with women from Ilimanu and Atauro to create their own savings and loan groups.

In recent years, income from traditional fishing has significantly fallen due to the increased number of fishers, destructive methods and damaging equipment. For a typical traditional fisher family in Timor-Leste, the head of the family can support their family with the little they can sell or take home from their catches. But during the rough seasons, most families would have to borrow money from neighbours or take a loan from the bank or a microcredit institution to make ends meet.

One of the main challenges for most of the rural and remote communities is that banks and formal financial institutions are far away from where they are. Just imagine the stress, for a fisher that needs to commute on a ferry boat that only runs a few times every week, walking into a bank and forgetting a crucial document. The more systemic problem is that community members may have to put their land as collateral, which they usually don’t have the documents for, for the same reason as above. The bureaucracy, the added costs and the barriers to accessing this essential service are momentarily relieved when the bank finally hands over the loan to you, in cash. But again, this is to the very few who can afford to open bank accounts.

But by the time they make half the payment with an expensive interest back to the bank, they realise too late that they need much more time to repay the money back to the lenders.

A member of the community savings and loan group locking the cashbox.

What is financial inclusion?

For us at Blue Ventures, it means that the fishers have access to financial services at the community-level, providing them with the cash means to withstand the short-term costs needed for long-term fisheries management and conservation efforts, and a platform for alternative livelihoods. When Locally Managed Marine Areas (LMMA) like no-take zones and temporary closures are established, the lives of the resource users and the rest of the community members will be tremendously impacted. Nevertheless, with an LMMA in place, the hope is that in the future, fishers’ access to the market will also increase; as the catch per unit effort (CPUE) increases then there is a need for financial services. Therefore, financial inclusion programmes like savings and loan groups create access to funds and capital that can sustain the well-being of the community in a dignified manner so they can afford to pay school fees for their children, access medication, be able to invest in alternative livelihood and with the ultimate goal of increase and control of assets at the household level. In three words: affordability, flexibility and accessibility.

Men and women from the Ilimanu village during the financial inclusion training.

A savings and loan group can be composed of men and women that save their money together and loans from personal savings to each other. Members normally come from the same sub-village and know and trust each other. The purpose of the group is to support one another with no judgement against one’s level of income, education or social status. And the group is guided by the group constitution.

The good news is, it is somewhat simple to form one. This programme is excellent for beginners, doesn’t require filling out complicated paperwork, has no collateral and the loan with interest will stay in your group.

Tahi-Opu group from Bikeli, Atauro island, on their first financial inclusion training

In Bikeli (Atauro), where trading seaweed has become the alternative livelihood for small-scale fishers, community members take loans to buy ropes for seaweed farming. In Pala, Bikeli is also where Blue Ventures first facilitated a group of 13 fisherwomen piloting a savings and loan programme.

Where should you start?

First and foremost, before we begin, we need a guide. As a marine conservation organisation, there is a great duty to pragmatically share financial knowledge about a self-financing system that is sustainable for rural fishers.

Community interviews, focus group discussions and community consultations are a great place to start where we can listen and learn about the challenges and needs in the community.

Consultation with members of the community, mostly women, who were interested in creating a savings and loan group

In our initial community consultation in Ilimanu (Manatuto) last year, we learned that a number of the coastal community members are under severe financial stress due to financial illiteracy, no local access to funds, and financial debts. While the fishers struggle to get a better catch, others take loans to open small restaurants selling low-priced, store-bought and freshwater grilled fish. In severe cases, some resort to the riskier route by taking on added loans from other credit institutions to repay the banks.

The group participants expressed their interest in forming a savings club with the goal of managing their finances better and investing in better returns. And so, the financial inclusion programme was introduced and remarkably, around 30 people enrolled for the training.

Blue Ventures facilitates bookkeeping training to Tahi-Opu group

In training, participants learn about how bookkeeping works, which includes how to calculate interest, and record cash in and cash out. The maths was kept as simple as possible and clearly explained, as this stage is specifically challenging for some of the participants. Hence, in training, it is recommended to keep reminding the participants of the purpose of this group: to support one another with no judgement against one’s level of income, education or social status.

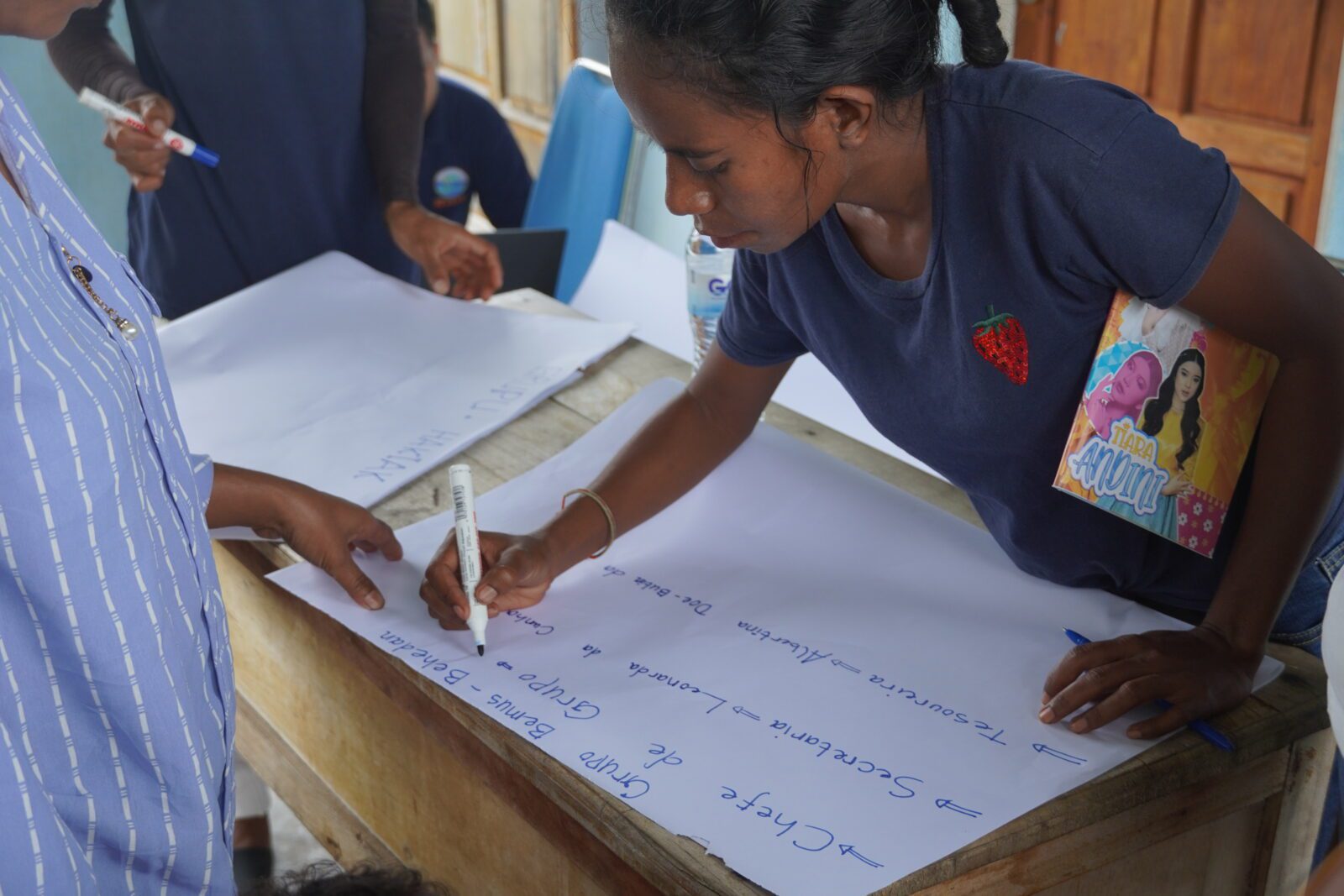

A member of a savings and loan group from Ilimanu drafting the group’s constitution

Money is a delicate issue for any household, and a new finance management system can be considered as risky when you are under crushing debt. As a result, only 10 women who trusted each other and their new abilities came forward and kicked off a savings and loan group launch in Ilimanu. They formed their own organisational structure where they selected a group leader, a bookkeeper, a cash box keeper, and cash box key holders.

Following this, monthly check-ins on the group, referred to as monitoring, are necessary to make sure the bookkeeping is accurate, and every member is on the same page and that the officials composed of the chairperson, treasurer, secretary (Record keeper) and money counters observe their roles. On my last visit, the women started loaning to other members, and few have also paid the loans back. Fearlessly, the group is planning to help a member build her own stand to sell freshly caught fish from the sea.

Blue Ventures supporting with monitoring the savings and loans group from Ilimanu’s bookkeeping.

Pros and cons

These groups have inspired other women to contribute to the household financially, beyond housework. They want to invest in their husbands’ fishing activities, local fisheries management, and their community. Financial inclusion can tackle challenges related to gender participation, natural disaster resilience, and community-led investments. At the same time, we need to anticipate some hurdles:

Pros

- Generate funds quickly

- The money stays in the group

- In case of emergency, the fund is available within walking distance

Cons

- Capital gains may lead to community jealousy

- Inaccurate bookkeeping may lead to losing trust in members and conflict

Handover of the cashbox after having received training from Blue Ventures.

There are multiple approaches to financial inclusion to accommodate different contexts, and this list can help us prepare for the challenges ahead. We must remember that these communities don’t lack resources, but they lack information. As a facilitator, we are simply providing them with a tool for them to thrive in their community. Beyond this, we would like to see the transformation at the household level. We want to see fishers, women and men, having resources, owning resources, and having control over their resources.

This initiative is funded by the UK Government through the Darwin Initiative.